As a lifeline for small businesses to survive the epidemic, Shopify still has huge potential to tap.

Among the tech giants such as Tesla, Microsoft, Google, and Apple, there is an e-commerce company whose performance attracts attention.

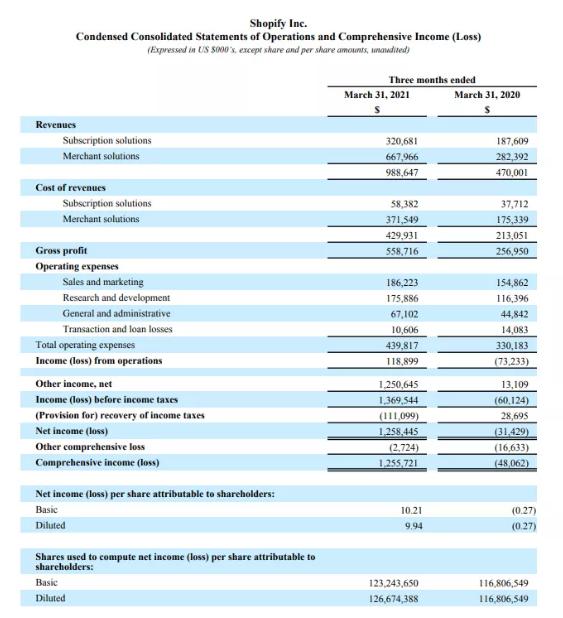

On April 28, Eastern Time, Canadian e-commerce giant Shopify released its 2021 Q1 quarterly performance report. In the quarter, revenue was US$989 million, an increase of 110% year-on-year, and net profit turned from loss to profit. A number of data greatly exceeded expectations, showing strong growth. After the announcement of the results, the stock price surged 11.4% on Wednesday. It highlights the affirmation and expectations of the market and investors on Shopify's performance.

Last year, the epidemic triggered the rapid development of global e-commerce, and Shopify has become the biggest dark horse on the track. Why does Shopify challenge the global giant Amazon? What are the advantages that make Shopify the biggest e-commerce beneficiary? Through this financial report, let us understand the new force of this global e-commerce retail industry.

Q1 turned losses into profits, revenue exceeded expectations

GMV doubled to release positive signals

Overall, the financial report showed that Q1 revenue was US$989 million, and the market expected US$865 million, compared with US$470 million in the same period last year. A year-on-year increase of 110%. Net profit was 1.258 billion U.S. dollars, the market expected a loss of 14 million U.S. dollars, and a loss of 31 million U.S. dollars in the same period last year. Of course, this includes the company's $1.3 billion unrealized gain on Affirm's equity investment.

As of March 31, 2021, the company's monthly recurring revenue (MRR) was US$89.9 million, a year-on-year increase of 62%. Shopify President Harry Finkelstein said in the earnings call that although the MRR contribution in the first quarter was still relatively small, it also benefited from the first full quarter increment we received from retail POS Pro subscriptions. income.

In this quarter's earnings report, Shopify's most eye-catching data is undoubtedly GMV.

Shopify 2021Q1 gross merchandise transaction (GMV) was 37.3 billion U.S. dollars, an increase of 114% year-on-year; total transaction payment (GPV) was 17.3 billion U.S. dollars, accounting for 46% of GMV this quarter, and last year was 7.3 billion U.S. dollars, accounting for 42%.

In just 5 years, Shopify’s GMV has grown from US$7.7 billion in 2015 to US$41 billion in 2018, and then to US$61 billion in 2019. By 2020, it will reach 119.6 billion U.S. dollars at a nearly double growth rate.

Shopify said that it expects that revenue growth in 2021 will be lower than that in 2020, and the adjusted operating profit for the whole year will decline year-on-year; the surge in GMV in 2020 will not occur again.

The US Stock Research Agency believes that although the explosive market like last year will not necessarily recur in the future, the doubling of GMV growth still releases a positive signal. Q1's revenue and GMV both doubled. Behind the strong growth is the increase in the share of retail spending for online purchases, the increase in GMV of each merchant, and the injection of the latest round of stimulus measures launched in the United States in March.

With the accelerated development of digital commerce, the growth of GMV continues to be promoted, and more and more merchants are developing business on the platform and adopting more Shopify services, all of which have brought positive feedback on Shopify's performance.

Shopify president said in the conference call: "Our e-commerce penetration rate in North America and the United Kingdom is still less than 30%. E-commerce still has broad room for development."

After the announcement of the financial report, Shopify rose by more than 3% before the market, and finally closed up by 11.4%, highlighting the affirmation and bullish sentiment of the market and investors on Shopify's performance.

Shopify's share price has risen by more than 16% this month. Last year, from the price of about US$400 in March 2020, the price has risen steadily.

The performance supports the stock price, and the stock price feeds back the performance. Both investors and the market have given Shopify more expectations.

In terms of rating, Piper Sandler raised Shopify's price target from $1,500 to $1,600 per share.

But there is also a downward adjustment: The Canadian Imperial Bank of Commerce lowered the price target of Shopify Inc. from US$1,750 to US$1,325 per share. The reason for some analysts' downgrades may be due to the slowdown in revenue growth.

The US Stock Research Agency believes that under the stimulus of the epidemic, the change in consumer preferences is not temporary. In the future, the global business focus must be online. Consumers have already voted with their wallets, and this trend has already existed. And relative to the total global retail industry, the scale of e-commerce is still small, and it will continue to maintain a good growth momentum. Optimistic about Shopify's future growth potential and its own advantages.

When we talk about the global e-commerce retail industry structure, we cannot avoid giants such as Amazon and Alibaba. How did Shopify rise step by step and become a challenger against Amazon?

E-commerce penetration accelerates leading to faster growth in performance

What is the follow-up trend of e-commerce dark horse Shopify?

Stimulated by the epidemic last year, online e-commerce broke out, and Shopify became one of the biggest e-commerce beneficiaries. From the price of about US$400 in March 2020, it has been steadily increasing, and it has reached a high of US$1,500 this year. This has also made Shopify the highest market value company in Canada.

Shopify's development route is from website building tools to platforms to e-commerce ecosystems. It is a typical enterprise-level service company's development route. Shopify has become the largest third-party online retail platform, and its ecosystem covers more than 2,000 third-party applications, and these applications have been installed millions of times by merchants operating stores on Shopify.

From the perspective of business structure, as a platform-based company, Shopify’s main business is divided into SaaS subscription services and merchant solutions (payment, financing, logistics, etc.). The former is the core business of e-commerce services, and the latter is in recent years. The focus of the effort.

The financial report shows that Shopify's Q1 subscription solution revenue was US$320.7 million, a year-on-year increase of 71%. The revenue of this business comes from the sale of subscriptions to the Shopify platform, including variable platform fees, as well as subscriptions to retail POS Pro products, topic sales, application sales and domain name registration.

The year-on-year growth of this business was mainly the result of MRR growth, which was largely driven by the increase in the number of merchants using our platform.

Business solutions revenue was $668 million, an increase of 137% year-on-year. President Harry Finkelstein said that this outstanding growth was mainly driven by strong sales.

The biggest difference between Shopify's SaaS subscription service and Amazon is that Shopify provides merchants with multi-channel front-end sales. With the help of Shopify, merchants can draw traffic from multiple channels such as e-commerce platforms, social networks, and third-party websites. Therefore, Shopify's traffic cost is more advantageous than Amazon and eBay.

For example, Shopify’s partners include dozens of social and e-commerce platform sales channels such as Amazon, Wal-Mart, Facebook, Twitter, Tik Tok, etc. Merchants can use the platform to directly manage to gain more traffic exposure, which helps merchants to improve Acquire a wide range of customers and drive sales.

Since last year’s epidemic, Shopify’s new SHOP function, including focusing on local brands and promoting repeat business may arouse consumers’ interest, and merchants’ sales and revenue will also increase. Positioned under social isolation to deepen the connection between consumers and businesses and enhance brand loyalty.

In addition, in terms of payment, Shopify has also worked hard. In February of this year, Shopify introduced Shop Pay to the Facebook platform, and consumers will be able to use Shop Pay to complete shopping. Shop Pay can also help users track parcels through the Shop application, providing the option of payment in installments.

The SaaS subscription service solves the front-end customer acquisition and traffic exposure problems of merchants, while the merchant's solution is to solve the problems of payment, financing, and warehousing in the back-end. This business is also the focus of Shopify's efforts over the years.

On the one hand, merchants use Shopify’s cheaper payment rates, data analysis and other services to reduce operating costs, improve operating efficiency and profitability; on the other hand, while meeting the actual needs of customers, Shopify also broadens the breadth of their business. , This part allows Shopify to penetrate deeper in the e-commerce industry chain. The two form a win-win situation. Therefore, the core advantage of Shopify lies in the perfect cooperation between the front end and the back end.

The President of Shopify believes that if Amazon is the iOS of e-commerce, Shopify is the Android of e-commerce.

The founder of Shopify once said: "Amazon is building an empire, and Shopify is trying to arm the rebels." Currently, Shopify has become a new force challenging Amazon.

Concluding remarks

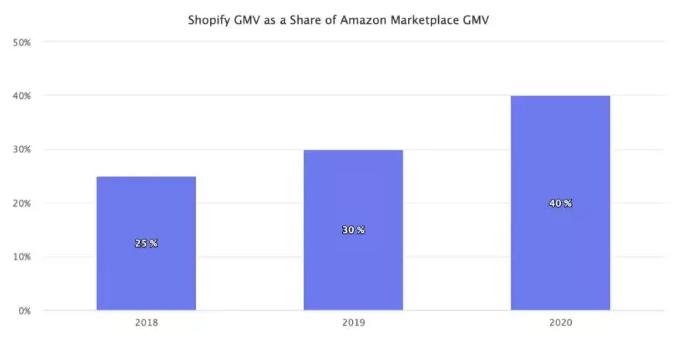

According to eMarketer data, Shopify accounted for 5.9% of all retail e-commerce sales in the United States last year, second only to Amazon's 37.3% share. In 2020, Shopify's GMV is 119 billion U.S. dollars, Amazon is 300 billion U.S. dollars, the former is 40% of the latter. In 2018, this proportion was only 25%.

In other words, in 2018, Amazon's market size was 3.9 times that of Shopify. By 2019, this value had shrunk to 3.3 times, and by 2020 it was only 2.5 times.

The rapid development of Shopify is an impact and threat to the e-commerce ecosystem of the Amazon platform. If in the next 5 years, Amazon's market size continues to grow by 25%, and Shopify's market size further grows by 50%, then Shopify will also be able to surpass Amazon.

Morgan Stanley analyst Keith Weiss said publicly: "Shopify is definitely a huge winner in the promotion of e-commerce. But in 2021, how long this growth will continue is the key issue."

For Shopify in 2020, after achieving brilliant data growth, physical stores and offline retail are expected to return in the post-epidemic era, which will have some impact on its subsequent growth. It is unlikely that 2021 will replicate last year's success. However, the employment problem caused by the epidemic is severe. Many young people in the United States have begun to engage in sideline businesses. As a lifeline for small businesses to survive the epidemic, Shopify still has huge potential to tap.

Source Your Products and Start Dropshipping